Stock Market Safety Tips!

Investing in the stock market can be a great way to build wealth, but it's important to remember that there are inherent risks involved. While it's impossible to eliminate risk completely, there are steps you can take to protect yourself and minimize potential losses.

"Precaution is better than cure" is an age-old adage that emphasizes the importance of taking preventive measures rather than waiting for a problem to arise and then trying to fix it. This principle is particularly applicable when it comes to investing in the stock market, where risks are inherent and losses can be significant.

In this blog, I’ll will explore some of the best practices and strategies for investing safely in the stock market.

Yes, the stock market is full of opportunities for investors to grow their wealth, but it’s important to be aware of the risks involved. With the right knowledge and strategy, beginners and seasoned investors can confidently navigate the stock market and achieve their financial goals. So, don’t be discouraged by the potential risks, but rather focus on learning and implementing safe investing practices to reap the rewards of the stock market.

Educate Yourself and Invest with Confidence

We know the importance of

protecting ourself from financial fraud. Unfortunately, fraudsters are skilled

at convincing people to invest in their schemes. That’s why it’s crucial to do

your own research before investing. Always ask questions and verify answers to

determine if a product is genuine.

Take the time to investigate

the person promoting the investment and check if SEBI licenses them to give

financial advice. Also, avoid unsolicited emails promoting a company without

any reliable financial information.

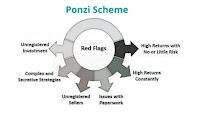

Investment Red Flags to

watch out for:

Investing can be a great way to grow your wealth, but it's important to be aware of the potential risks and red flags that can indicate an investment is not legitimate or may not be right for you. Here are some common investment red flags to watch out for:

Growth Hacking 101

Here are some common investment red flags to watch out for:

1. Promises of High Returns with No Risk:

No investment

is completely risk-free, and if someone is promising high returns without any

risk, it's likely too good to be true. It is a scam if someone promises to offer

abnormally higher yields than the indices have offered historically.

2. Unsolicited Investment Opportunities:

If someone

you don't know or trust is offering you an investment opportunity out of the

blue, be cautious. It's important to do your own research and seek advice from

a financial professional before investing. Guaranteed returns do not exist in the stock

market. Every investment carries a certain risk.

3. Unregistered Investment Products:

Always check

to make sure an investment opportunity is registered with the appropriate

regulatory authorities. Unregistered products may be scams or may not meet

regulatory standards.

4. Lack of Transparency or Information:

If an

investment opportunity seems vague or the person offering it cannot provide

clear information, it's a red flag. It's important to fully understand an

investment before putting your money into it.

Growth Hacking 101

5. Pressure to Invest Quickly:

High-pressure sales tactics can be a sign of a scam. Fraudsters often use the FOMO tactic to convince you to invest money immediately. Take your time to thoroughly research an investment and never feel rushed into making a decision.

6. Don’t be Fooled by a Professional-Looking Website.

Scammers can easily create one. A professional-looking website can be deceiving when it comes to investing. Scammers often create impressive websites to lure in unsuspecting investors. Always conduct thorough research and verify the legitimacy of an investment opportunity before investing, regardless of how professional the website looks.

By keeping an eye out for these investment

red flags, you can protect yourself and your finances from potential scams or

investments that may not be right for you. Always do your own research, seek

advice from professionals, and trust your gut when it comes to investing.

Due Diligence is a Must!

Due diligence is a critical part of the investment process that involves researching and verifying the legitimacy and potential risks of an investment opportunity. It's important for investors to conduct thorough due diligence before making any investment decisions to ensure they are making informed choices and minimizing their exposure to potential risks. This process can include researching the company or investment product, analyzing financial statements, seeking advice from financial professionals, and reviewing regulatory filings. By conducting due diligence, investors can make informed decisions and avoid potential scams or investments that may not be right for their financial goals and risk tolerance.

Finding the right investment

partners is also not easy these days because you might just come across

self-declared market experts on every social media platform. Hence, check if

SEBI licenses the company or the analyst to run its business operations before

investing.

How to Raise a Complaint to SEBI?

The Securities and Exchange Board of India (SEBI) is the regulatory body responsible for overseeing the securities markets in India. If you have a complaint related to the securities market, you can file a complaint with SEBI to seek redressal. If you come across any fraudulent person or a group offering unsolicited financial advice on any social media platform, you can easily reach out to SEBI by registering a complaint on their Portal.

To raise a complaint with SEBI, you can

follow the steps outlined below:

1. Visit the SEBI website and go to the

"Complaints" section.

2. Click on "Complaint Registration" and fill in

the required details such as your name, address, contact information, and a

brief description of your complaint.

3. Upload any supporting documents that are relevant to your

complaint.

4. Review the information you have provided and submit the

complaint.

5. SEBI will review your complaint and may request

additional information if needed. They may also refer your complaint to the

appropriate authority if it falls outside their jurisdiction.

6. You can track the status of your complaint through the

SEBI website or by contacting the SEBI investor helpline.

It's important to note that SEBI can only take action on complaints related to violations of securities laws and regulations. If your complaint is related to a dispute with a broker or other market participant, you may need to seek legal or arbitration recourse.

In summary, stock market

safety is all about taking steps to protect your investments from potential

losses. Diversifying your portfolio, sticking to a long-term strategy,

investing in quality companies, keeping an eye on fees, using stop-loss orders,

and staying disciplined are all important measures you can take to safeguard

your capital and minimize risk.

Happy investing!

No comments:

Post a Comment