Investing in the stock market is a great way to grow your wealth over time. However, there are many myths surrounding the stock market that can be misleading and prevent people from investing.

In this blog, I’ll debunk some of the most common myths about investing in the stock market.

In this blog, I’ll debunk some of the most common myths about investing in the stock market.

MILLIONAIRE SECRETS

One of the most common myths about investing in the stock market is that it is just like gambling. This couldn't be further from the truth.

In fact, investing in the stock market is all about making informed decisions. It requires research, analysis, and a sound investment strategy. While there is always some degree of risk involved in investing, you can mitigate that risk by diversifying your portfolio and investing in stocks that have a proven track record of success.When you invest in the stock market, you are

essentially buying a small piece of ownership in a company. You are betting on

the company's ability to grow and generate profits over time. This is very

different from gambling, where the outcome is purely based on luck.

Myth #2: Investing in the Stock Market is only for the Rich

In fact, you can start investing in the stock market with very little money. There are many low-cost investment options available, such as mutual funds and exchange-traded funds (ETFs), that allow you to invest in a diversified portfolio of stocks.

Many investment platforms allow you to start

investing with as little as Rs. 500 per month or $10. Additionally, with the

rise of fractional shares, you can invest in some of the biggest companies in

the world without needing to buy a whole share. This makes investing in the

stock market accessible to everyone, regardless of their income level. The key

is to start small and build your portfolio over time.

Myth #3: You need to be a Financial Expert to

invest in the Stock Market

While a financial advisor can be helpful, you don't necessarily need to hire one to invest in the stock market. There are many resources available online and in books that can help you learn the basics of investing. Additionally, many investment platforms offer tools and resources to help you make informed investment decisions. However, if you are unsure about how to invest or need help developing a sound investment strategy, it may be worth considering hiring a financial advisor.

MILLIONAIRE SECRETS

Myth #4: Investing in the Stock Market is a Get-Rich-uick scheme

Another common myth about investing in the stock

market is that it is a get-rich-quick scheme. Many people believe that

investing in the stock market is an easy way to make a lot of money quickly.

However, this is far from the truth.

Investing in the stock market requires patience, discipline, and a long-term investment strategy. While some people may get lucky with a few high-risk investments, it is not a sustainable way to build wealth. Most successful investors take a long-term approach to investing and hold their investments for many years to take advantage of the compounding effect.

The stock market can be a great way to grow your

wealth over time, but it is not a get-rich-quick scheme. It requires patience,

discipline, and a long-term.

Myth #5: You can Time the

One of the most dangerous myths about investing in

the stock market is that you can time the market. This myth suggests that by

buying and selling stocks at the right time, you can maximize your returns and

avoid losses. However, timing the market is incredibly difficult, if not

impossible to do, even for experienced investors.

The stock market is notoriously unpredictable, and it is impossible to predict short-term movements with any degree of accuracy. Even the most experienced investors cannot consistently time the market. In fact, trying to time the market can be very risky and can lead to missed opportunities and lost returns. Instead, it is better to focus on a long-term investment strategy and make investment decisions based on sound research and analysis.

Myth #6: You need to follow the News constantly to

invest in the

While it is important to stay informed about the stock market, you don't need to follow the news constantly to be a successful investor. It is more important to focus on the fundamentals of the companies you are investing in and make investment decisions based on long-term trends.

Myth #7: Investing in the Stock Market is too Risky

While there is always some degree of risk involved in investing, investing in the stock market is not necessarily too risky. Historically, the stock market has delivered an average annual return of around 10%. This means that if you had invested Rs. 1 lakh in the stock market 30 years ago, your investment would be worth around Rs. 17 lakhs today. Of course, there are no guarantees in the stock market, and past performance is no guarantee of future results. However, over the long term, the stock market has proven to be a reliable way to build wealth.

In fact, there are many ways to mitigate risk, such

as diversifying your portfolio and investing in stocks with a proven track

record of success. While there is always a level of risk involved in investing,

the stock market is actually one of the most reliable ways to build wealth over

time.

Myth #8: You need to constantly Buy and Sell stocks

to make Money

Another common myth about investing in the stock

market is that you need to constantly buy and sell stocks to make money. This

is simply not true. In fact, most successful investors take a long-term

approach to investing and hold their investments for many years.

This is because the stock market tends to move in cycles. While there may be periods of volatility and short-term fluctuations, over the long term, the stock market tends to trend upwards. By taking a long-term approach and holding your investments for many years, you can benefit from the compounding effect of your investments, which can help you build wealth over time.

Moreover, constantly buying and selling stocks can

actually be detrimental to your investment returns. This is because each

transaction incurs brokerage fees and taxes, which can eat into your returns. While

active trading can be profitable in some cases, it requires a lot of time and

effort. By taking a long-term approach and avoiding unnecessary trading, you

can minimize your transaction costs and maximize your returns. For most people,

a buy-and-hold strategy is a more effective way to build wealth over time.

Myth #9: The Stock Market is too Unpredictable

While it is true that the stock market can be volatile, it is not necessarily unpredictable. In fact, the stock market tends to follow certain patterns over time, and there are many tools and resources available to help investors make informed decisions. By doing your research and investing in stocks with a proven track record of success, you can mitigate risk and increase your chances of success.

Myth #10: The Stock Market is only for Short-Term

gains

While some investors may focus on short-term gains, investing in the stock market is not only about making quick profits. In fact, many successful investors take a long-term approach, investing in stocks with strong fundamentals and holding onto them for years or even decades. By investing for the long-term, you can take advantage of the power of compounding and achieve significant growth over time.

Myth #11: You need to have a lot of Time to invest

in the

While it is true that investing in the stock market does require some time and effort, you don't need to devote all of your time to it. With the rise of low-cost investment platforms and online resources, it is easier than ever to invest on your own, and you can manage your investments in just a few hours per week. Additionally, many successful investors take a long-term approach, investing in stocks with strong fundamentals and holding onto them for years or even decades.

Myth #12: Investing is only for the Young

While it's certainly true that the earlier you

start investing, the more time your money has to grow, it's never too late to

start. Even if you're starting later in life, investing can still be a great

way to grow your wealth and achieve your financial goals.

In fact, investing can be especially important for older adults who may be approaching retirement or already retired. By investing in a diversified portfolio of stocks and bonds, you can help ensure that your money lasts throughout your retirement years.

MILLIONAIRE SECRETS

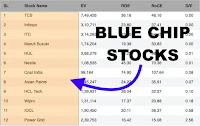

Blue-chip stocks are stocks of well-established companies that have a long history of stability, reliability, and consistent growth. While it's true that blue-chip stocks tend to be more stable than other stocks, they are not always safe investments. Investing in any stock carries a certain amount of risk, and blue-chip stocks are no exception.

Another important factor to consider is that blue-chip stocks may not offer the same level of growth potential as smaller or newer companies. While blue-chip stocks may offer more stability and consistent returns, they may not have the same growth potential as high-growth stocks or emerging companies.

Additionally, even well-established companies can face unexpected challenges, such as legal or regulatory issues, technological disruptions, or changes in consumer preferences. These challenges can have a significant impact on the company's financial performance and stock price, regardless of its blue-chip status.

Investors should consider a variety of factors, including valuation, potential challenges, and growth potential, before making investment decisions.

Myth #14: Investing in the Stock Market is too Complicated

Finally, many people believe that investing in the

stock market is too complicated. They may be intimidated by the jargon and

technical analysis that is often used by investors and financial advisors.

However, investing in the stock market is not as complicated as it may seem.

In fact, many online brokerages and investment platforms have made it easier than ever to start investing in the stock market. They offer user-friendly interfaces, educational resources, and low-cost investment options that make it easy for anyone to get started. By doing some research and taking the time to learn, you can become a successful investor even if you are not an expert.

CONCLUSION

Investing in the stock market

can be a great way to grow your wealth over time and achieve your financial

goals. However, there are many myths surrounding the stock market that can be

misleading and prevent people from investing. By debunking these myths, we hope

to encourage more people to take advantage of the opportunities that the stock

market has to offer. Remember to do your research, diversify your portfolio,

and develop a sound investment strategy to maximize your chances of success.

So, start investing today and take the first step towards building your financial future.

Please note that investing in the stock market involves risks and can result in potential losses. Past performance of stocks or the stock market as a whole does not guarantee future results or returns. It is important to conduct thorough research and analysis before making any investment decisions, and to have a clear understanding of your investment goals and risk tolerance. This information is not intended to be investment advice, and you should consult with a financial advisor or professional before making any investment decisions. The stock market is subject to volatility and market fluctuations, which can impact the value of your investments. Therefore, any investment in the stock market should be made with caution and after careful consideration of all the associated risks.

No comments:

Post a Comment